Who Else Wants Tips About How To Sell Stock Options

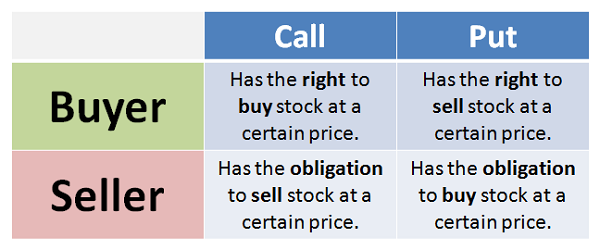

There are two types of options:

How to sell stock options. There are 15 points for picking the best stocks to sell options on. A $1 increase in the stock’s price doubles the trader’s profits because each option is worth $2. Once you’re ready to buy shares in alphabet, log in to your investing account or trading app.

Then, he or she would make the appropriate. Step one to learning how. Basically, you’re buying the option to buy or sell an underlying stock at a certain price.

Option sellers want the stock price to remain in a fairly tight trading range, or they want it to move in their favor. Another option for selling private stock is to sell on a secondary marketplace. When you sell options, you want to have that.

In short selling, the potential reward may be limited because most of the stock’s losses are zero, and the value of the stock can increase indefinitely while the risk is theoretically unlimited. If the stock goes in the opposite. If the next target of $120 is hit, buy another three contracts, taking the average price to $92.22 for a total of 18 contracts.

Selling shares in a secondary transaction. How to trade stock options: Type in the ticker symbol googl and the number of shares.

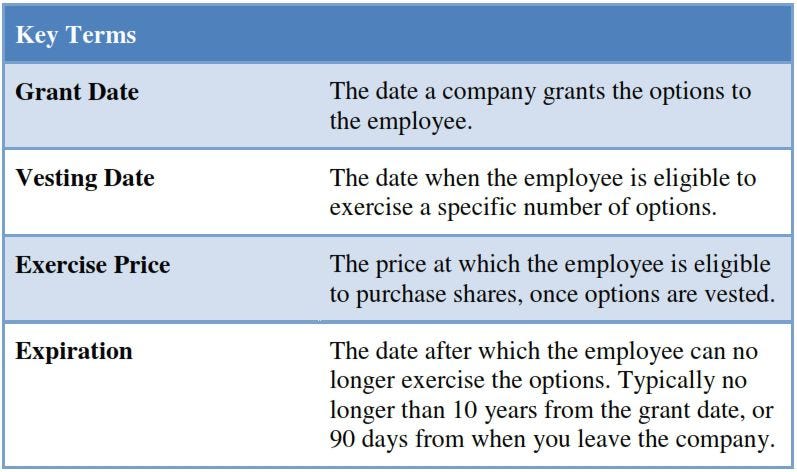

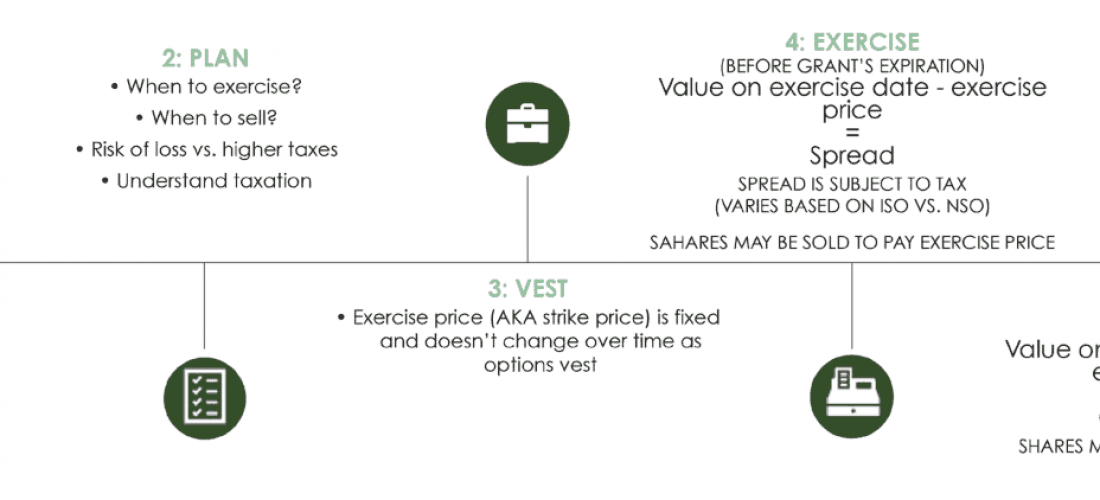

The problem is that the stock must make the desired move before expiration. It is also one of the riskiest strategies that could wipe out an entire. Once your options are vested, you have the right to buy (exercise) your company stock at a fixed price (exercise price, or strike price) at any point before the grant expires.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Stock_Option_Definition_Aug_2020-01-ba7005182cda419a883d6b140a04ef09.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_The_Ins_and_Outs_of_Selling_Options_Oct_2020-02-4a221b389aba4253b4faec37740bbda5.jpg)

:max_bytes(150000):strip_icc():gifv()/stockoption_color_v1-9be9f659f9d04eeea7733d06200c5ef3.png)