Here’s A Quick Way To Solve A Info About How To Reduce Personal Debt

Seven steps to controlling your debt figure out how much you owe.

How to reduce personal debt. Ask yourself if you would you rather own a particular item or be in debt, and then act accordingly. We'll match you up to 5 lenders for your best credit card consolidation loans. This is perhaps your best tool to get out of.

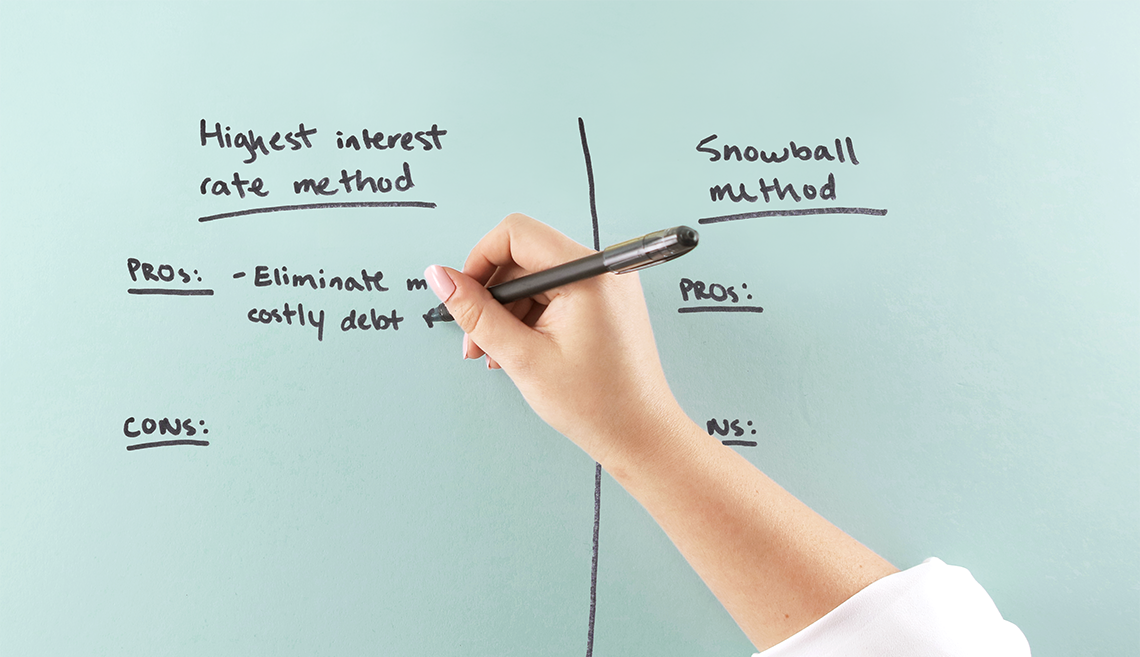

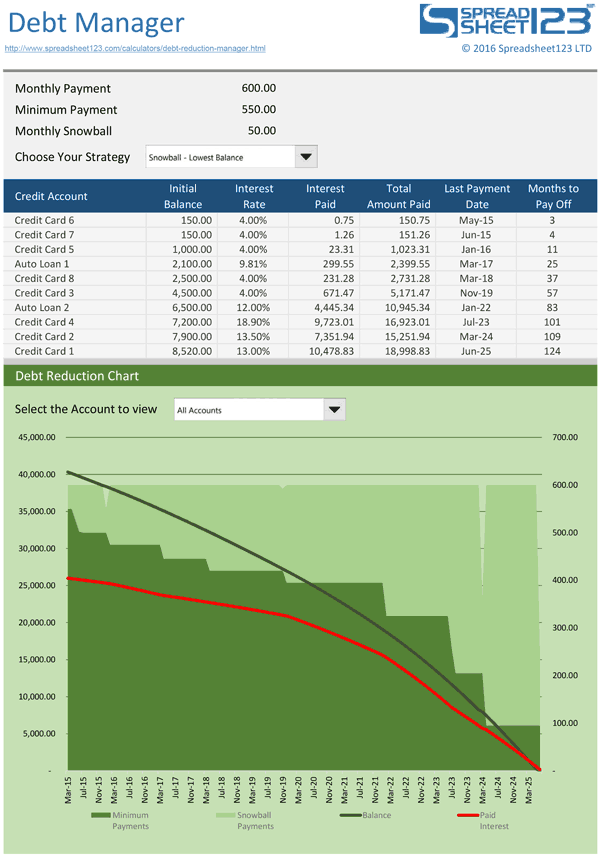

Consolidate combining your debt and paying it off with a debt consolidation loan can give you a lower monthly payment. Yet the average retirement age has fallen from 65 to 62. Average the interest rates on your current balances.

Reduce your personal debt while maintaining a healthy credit score. Using this bit of extra income for daily expenses can help save money and. If your personal debt has reached a point where you feel overwhelmed and don’t know where to begin, the best course of action is to take a step.

You can even ask your. How to reduce or eliminate debt stop accumulating debt. 1) raise the retirement age.

Use a balance transfer, personal loan, or home equity loan to consolidate high interest debt into one lower interest payment. See offers from verified better business bureau® accredited partners. Write down how much you owe and the creditor, which may help you visualize a plan for paying off your debts.

Increase your emi if you know that your income is going to increase over time, it is recommended to increase the emi amount to reduce your personal loan debt burden. The two most common ways to consolidate debt are through a debt consolidation loan or using a debt management. Ad compare personal loans and lower your interest rate by consolidating your credit cards.

_1.jpg?ext=.jpg)